Michael Carter II

Michael Carter II is a professional NFL cornerback for the Philadelphia Eagles. A Georgia native, he was born in Atlanta and raised in Douglasville, where he attended South Paulding High School. Excelling in both football and baseball, Carter II earned multiple local and state honors, including county player of the year in baseball and defensive player of the year in football. He also participated in several prestigious football showcases, such as those hosted by Nike and Rivals.

At Duke University, Carter II built an impressive career on and off the field. As a key defensive back since his freshman year, he eventually became a team captain for the Blue Devils. In 2020, his standout senior season earned him All-ACC honors. His academic achievements were equally remarkable, with multiple Academic All-ACC selections. He was also a semifinalist for the Jason Whitten Collegiate Man of the Year Award and a candidate for the distinguished William V. Campbell Trophy. His talent led to his selection in the fifth round of the 2021 NFL Draft by the New York Jets, where he has since established himself as one of the league's premier nickel cornerbacks. Five years later sees him now with the Philadelphia Eagles.

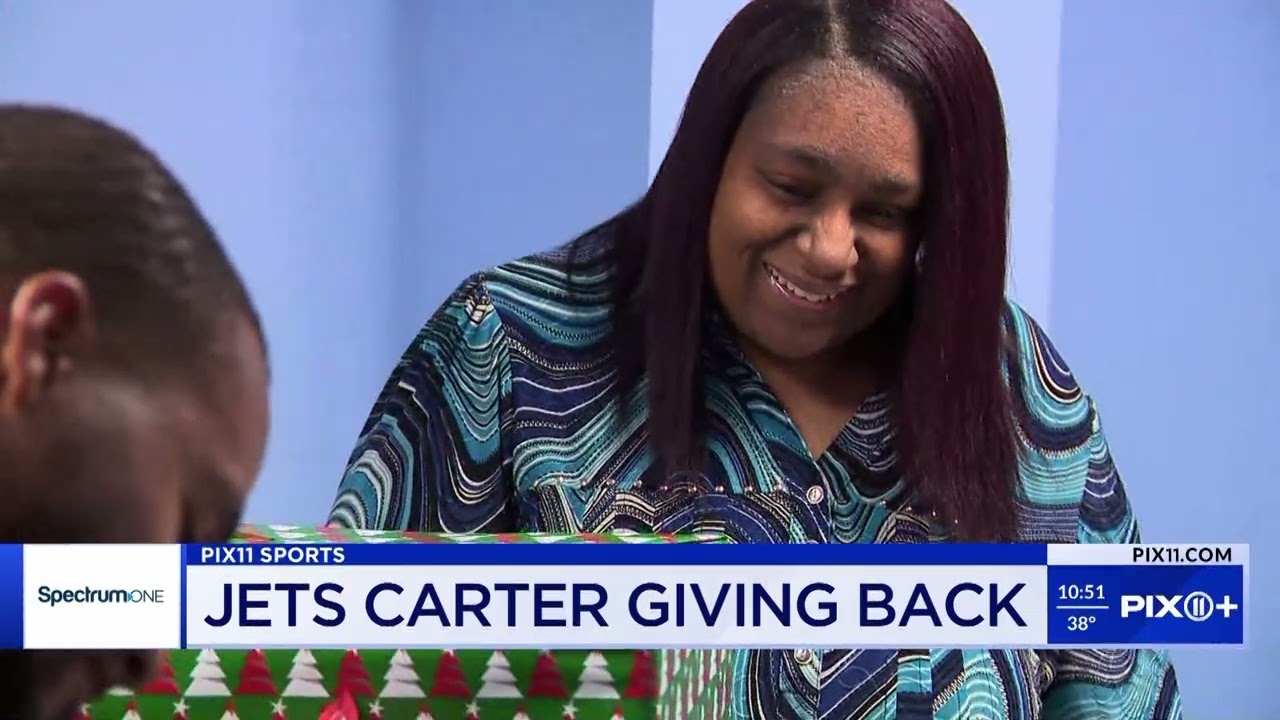

Beyond football, Carter II is a member of the Omega Psi Phi Fraternity, Inc. by way of the Omega Zeta Chapter at Duke University. Carter II values family and faith, believing in the importance of both. He is a dedicated husband and family man, and enjoys spending time with his dog, “Duke”. He also gives back to his community by hosting free football camps and supporting youth athletics. In his downtime, he enjoys gaming and staying connected to the sport he loves through mentorship and charitable efforts.

Youth Football Camps

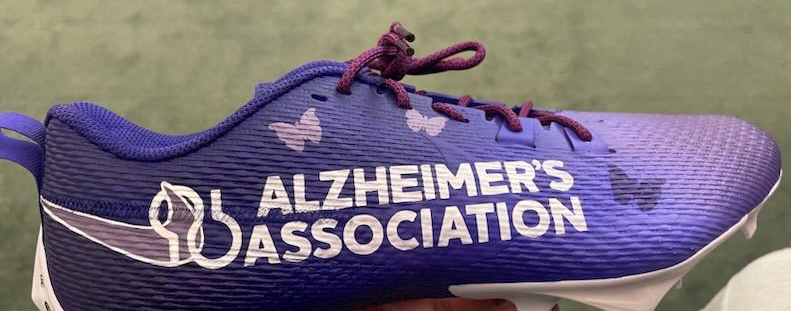

Cherished causes.

2025 HAFI Golf Sponsor